Any startup needs to pay close attention to its financial balance to be successful. You must keep track of where the money comes from, where it goes, how well it performs, and how it will perform in the next few months.

Financial planning tools will put you on track to accomplish your goals, such as reaching a specified revenue target within the given time frame. Investors reward entrepreneurs who support their goals with precise, well-detailed insights in their pitch decks.

In this article, we’ll look into the best financial planning tools to help you succeed in your business.

Top 13 Financial Planning Tools for Startups

You’ll need reliable financial planning tools to achieve your goals, as some tasks are simply too complex to manage manually. Whether you’re creating detailed investor reports, analyzing cash flows, or handling payroll, the right tools make a difference. Below are the tools used in financial planning that can help you track your startup finances.

Billing & Invoicing Financial Planning Tools

Tools for billing and invoicing will assist you in collecting payments on time and consistently while minimizing the errors resulting from manual data entry.

Billing software applications allow you to keep track of the items and services that your customers utilize. It also allows you to create, send invoices, and receive money. With the help of these financial planning tools, your team members can eliminate the tedious activities they have to do every day.

1. Zoho Invoice

Zoho Invoice is a free, user-friendly tool for billing and e-invoicing. It automatically manages recurring bills, provides GPS-based expense tracking for trips, generates thorough reports, and even includes a self-service portal where consumers can inspect their invoices, and estimations, and make payments.

Zoho Invoice has a simple, straightforward design and useful features, making it an excellent choice for small businesses and freelancers.

Zoho Invoice Features Include:

- Bill Processing.

- Bill Generation.

- Integration with Payment Gateways.

2. MyBillBook

MyBillBook allows you to design, print, and share professional GST or non-GST bills that are entirely customizable. It supports the digitization of everyday business transactions, as well as the proper tracking and management of business inventory through features like stock adjustments, low-stock notifications, etc. Also, you can send automatic payment reminders to consumers.

MyBillBook Features Include:

- Account Receivables

- Automatic Backup

- Gst Invoicing/ Billing

- Offline Billing

- Payment Collection

- Invoice Processing

- Invoice Management.

3. CaptainBiz

CaptainBiz is an easy-to-use invoicing tool that can help you streamline your business operations. It allows you to make invoices, manage customers and suppliers, and track both cash and bank transactions in one convenient location. CaptainBiz effortlessly meets your requirements, regardless of whether your business uses the GST system or not.

CaptainBiz Feaatures Include:

- Profit And Loss Statements.

- Billing & Invoicing.

- Inventory Management.

- Sms & Email Integration.

- Financial Management.

Payroll Management Tools

For any business, keeping track of employee financials is essential. Payroll management tools simplify this process by managing everything from salaries and deductions to bonuses and pay slips. To effectively manage payroll, you must understand each step of the process, including monitoring work hours, calculating compensation, and guaranteeing timely payments.

One of the most difficult aspects is calculating wages, deductions, taxes, social security, and health insurance.

There are additional details like overtime, benefits, bonuses, loans, allowances, vacation days, and final take-home pay. A reliable payroll tool can manage all of this, simplifying the process and keeping things accurate.

4. Wallet HR

Wallet HRis a complete human resource management tool that primarily provides payroll solutions. It promotes seamless workflow management and improves operational efficiency by leveraging innovative capabilities.

Wallet HR manages everything from hiring to retirement. It provides live online and in-person training. It also offers services for attendance, benefits, employee life cycle, payroll, self-service portal, and training management.

Wallet HR Features Include:

- Payroll Management

- Expense Management

- Reimbursement Management

- Bonus, Loans, and Advances Management

- Attendance Management.

- 360-degree Feedback.

5. Zoho Payroll

Zoho Payroll is a cloud-based payroll management tool that automates and simplifies the whole payroll administration process. This tool manages everything from centralizing and organizing personnel data and information to arranging paychecks and ensuring statutory compliance.

Zoho Payroll Features Include:

- Payroll Processing.

- Payroll Benefits.

- Taxes and Forms.

- Payroll Management and Administration.

- Employee Management and Onboarding.

Expense Tracking Tools

Organizations use expense-tracking tools to track, manage, and report their spending. The expense tracking tool enables employees to directly submit their expenditures for compensation. Along with simplifying and automating expenditure inputs. These tools streamline the review and approval processes by eliminating the need for manual labor, resulting in less administrative effort.

These software tools provide management with complete visibility into how employees spend the company’s money and ensure there is no financial malpractice. This allows the leadership to have tight control over the cash distributed to various teams, departments, and individuals.

6. Happay

Happay is also an expense management tool that automatically records your business spending, including staff charges. It allows you to track petty cash and travel expenditures. This provides the option to use a prepaid card, which allows customers to easily add and remove funds. You can produce a variety of custom reports based on your needs.

Happay Features Include:

- Expense Reports.

- Bank/Credit Card Integration.

- Digital Receipt Management.

- Smart Categorisation.

- Automated Reminders.

7. Rydoo

Rydoo makes careful expenditure management accessible to every department inside your company. It allows you to scan receipts using a camera, smartphone, or email. Its user-friendly design makes it simple to navigate between screens. The dashboard keeps things organized and tidy. It is an excellent tool for SMEs and non-technical people.

Rydoo Features Include:

- Expense Report Creation.

- Bank/Credit Card Integration.

- Digital Receipt Management.

- Currency Conversions.

- Mileage Tracking.

- Reporting.

- Automated Reminders.

8. Expensify

Expensify is a complete expenditure management tool suitable for small and medium-sized businesses, freelancers, and other independent contractors. It is the most comprehensive expense reporting app, enabling you or your staff to scan receipts for reimbursement.

Expensify uses optical character recognition (OCR) technology to upload and categorize receipts. This allows you to connect your credit card accounts and submit receipts from third-party sources.

Expensify Features Include:

- High-Quality Mobile Receipt Scanning.

- Expense Report Creation.

- Bank/ Credit Card Integration.

- Digital Receipt Management.

- Mobile Receipt Capture.

- Automated Reminders.

- Reporting.

Cash Flow Analysis Tools

Controlling cash flow involves tracking how much money comes in from operations, customers, and projects, how much leaves, and where.

Monitoring cash flow helps business owners and CFOs ensure there is enough cash to pay monthly costs and detect potential shortages. There are several tools available to help with improved cash flow management.

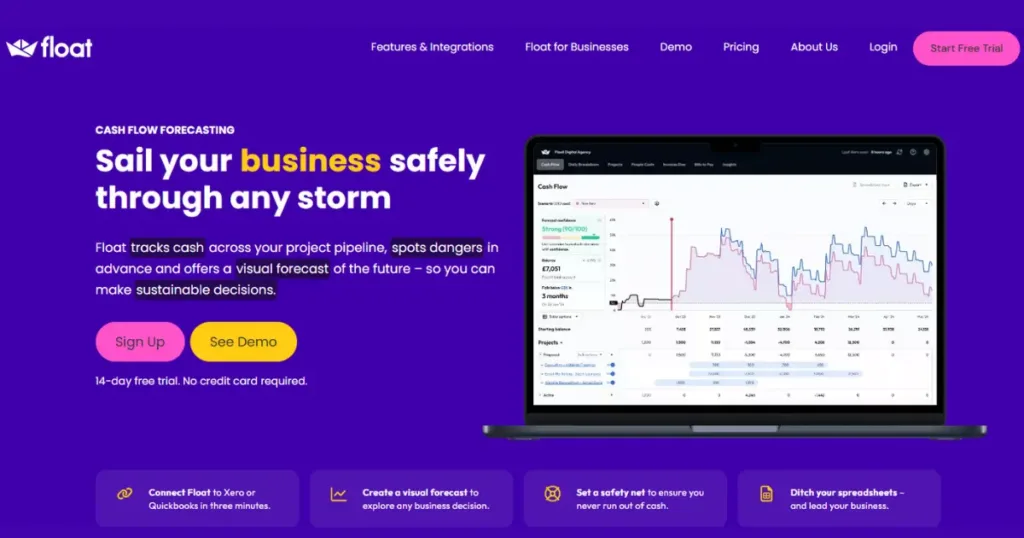

9. Float Cash Flow

Float cash flow is a cash flow forecasting add-on for companies that use accounting software, such as Xero, Quickbooks, or FreeAgent. This creates cash flow statements that are accurate, up to date, and take a fraction of the time to complete.

Float Cash Flow Features Include:

- Budget Creation

- Budget Management

- Forecasting

- Analytics.

10. Caflou

Caflou is a digital cash flow management tool that helps you better organize your business, track costs, create budgets, and manage cash flow. It enables you to examine previous cash flows and anticipate future cash flows.

Furthermore, it allows you to examine and analyze revenue and costs per client and project, as well as scheduled and paid projects. Caflou helps you identify areas where you can save money. It interacts well with Zoho Books.

Caflou Features Include:

- Customer Management

- Financial Management

- Billing & Invoicing

- Time and Expense Tracking.

Bookkeeping and Accounting Tools

Bookkeeping and accounting tools are important for managing a company’s financial operations. There are tools available on the market, ranging from simple accounting tools to those that control the whole flow of money into and out of large enterprises.

These tools enable your accounting department to be more productive while avoiding costly bookkeeping blunders. Below is the list of tools you can use:

11. Freshbooks

Freshbooks is an outstanding financial tool for SMEs. It is simple to use and will guide you through each step on your first try. It works well for new founders with no financial experience.

FreshBooks offers invoicing solutions that allow you to create customized, professional-looking invoices, work estimates, and formal proposals. As an added plus, the program allows you to manage projects for clients, track time, and connect to your bank account.

Freshbooks provides an automatic recurring billing tool and an automated method of collecting money from consumers, allowing them to see their outstanding balances and make payments.

Freshbooks Features Include:

- Balance Sheet

- General Ledger

- Accounts Payable

- Bank Reconciliation.

- Journal entries.

12. QuickBooks

QuickBooks is a useful tool for automating accounting. When it comes to flexibility, adaptability, and scalability, QuickBooks’ capabilities are unmatched. You can personalize this tool to fit the demands of your business.

Simple to use, Quickbooks teaches accounting basics to beginners. You can create and send professional GST invoices. It includes modules for inventory management, configurable GST reporting, extensive payroll support, and add-ons.

QuickBooks Features Include:

- Invoice Customisation.

- Payment Processing.

- Reconciliations.

- Financial Statements.

- Budgeting/Forecasting.

13. Xero

Xero is an accounting tool designed for small businesses that require a mobile-friendly application. Its multi-currency features make it a perfect option for those who do business across international borders.

It also enables you to link your bank accounts in order to better manage earnings and spending. Additionally, it lets you retain a record of your entries. If necessary, you can send all financial reports to Microsoft Excel.

Xero Free Features Include:

- Journal entries

- Invoice Customization

- Payment Processing

- Reconciliations

- Custom Reporting

- Financial Statements

Related Questions on Financial Planning Tools

1. What is a financial planning tool?

A financial planning tool is a resource that helps people handle their money, make budgets, keep track of spending, manage investments, handle bills, and plan for their future finances. These tools make it easier to see your short-term and long-term financial goals.

They help you understand your finances better and allow you to make smarter choices to reach those goals.

2. What is a financial planning?

Financial planning means making a plan to achieve your short-term and long-term money goals. It looks at your current money position, including your bank statements, income, debts, expenses, taxes, and savings.

3. What are the 7 key components of financial planning?

There are seven main key components of a financial plan:

1. Tax planning

2. Estate planning

3. Investment planning

4. Debt management

5. Cash flow management

6. Risk management and insurance planning

7. Retirement savings and income planning

4. What are the types of financial planning?

There are four main types of financial planning:

- Retirement planning

- Investment planning

- Insurance planning

- Tax and estate planning

5. What are the 3 rules of financial planning?

There are three main rules to follow in financial planning

- Examine your finances and set your goals

- Organise your budget

- Have a savings strategy

Conclusion

In this post, we’ve discussed some useful tools for billing, payroll, spending management, and cash flow analysis. With these tools, you can streamline operations, reduce manual work, and focus on growing your business with confidence. Whether your startup is new or scaling up, the right financial tools are essential to reaching your goals.

So, take the time to explore which of these tools fits your startup’s unique needs. By doing so, you’ll be creating a solid foundation for sustainable growth and long-term success.

This is a good time to put your company online if it hasn’t already! With our user-friendly website builder, QuickLaunch, TechDella is ready to make it simple for you to get started. Get started with a free 14-day trial and see just how simple and enjoyable building your own website can be!

My name is Omolola, I am a dedicated Content Writer at Techdella. I excel in simplifying complex procedures and keeping audiences informed with the latest trends. With a passion for staying updated in the fast-paced digital world, I spend considerable time online to ensure my content remains relevant and engaging.

Get it in your inbox

One email a week. Real startup marketing insights — no filler.

Join 1,400+ founders. Unsubscribe anytime.

You're in!

Thanks for subscribing. Your first issue will arrive shortly.